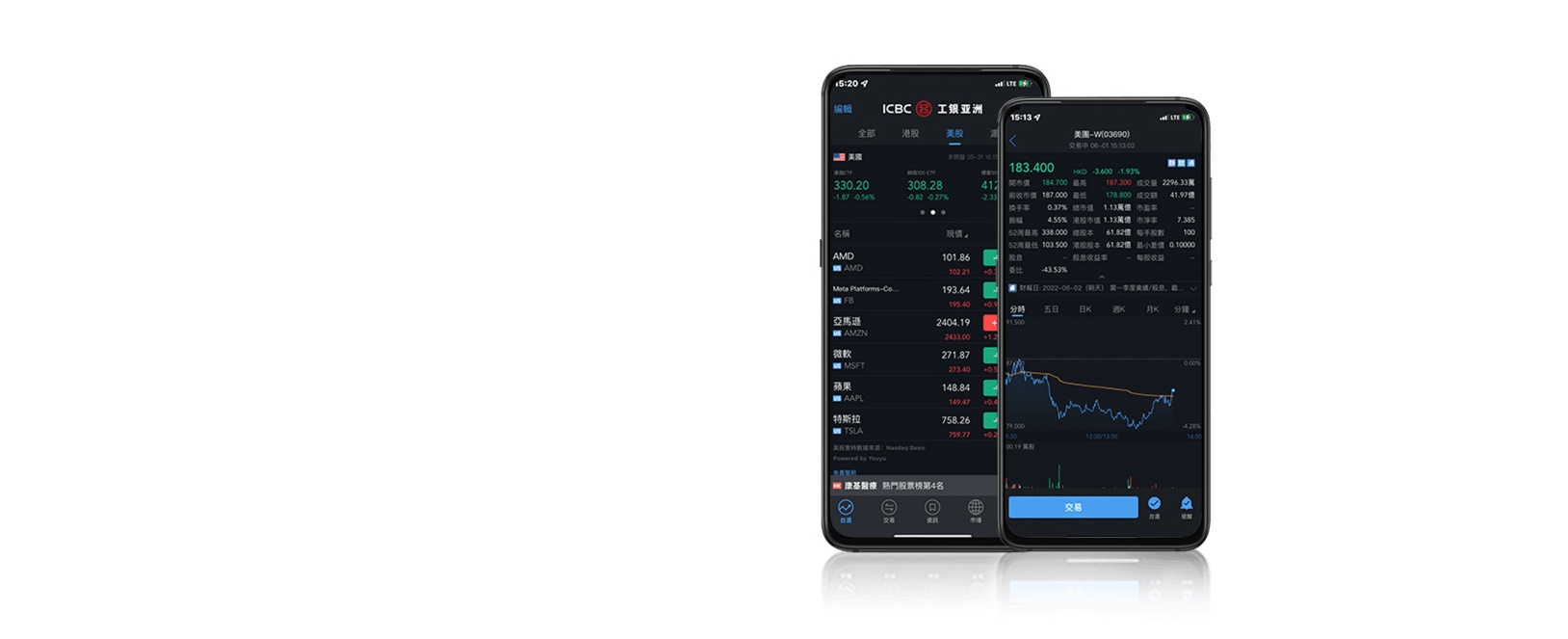

ICBC Smart Invest - ICBC (Asia)

The “ICBC Smart Invest” APP is designed for securities trading customers of ICBC (Asia). Download “ICBC Smart Invest” APP to enjoy all-in-one, simple, convenient and trustworthy securities trading services which include trading of Hong Kong stocks, Shanghai or Shenzhen Stock Connect Northbound stocks, US stocks, IPO shares cash or financing subscription, etc. “ICBC Smart Invest” APP helps you to seize the investment opportunities.

ICBC (Asia) customers can simply log in “ICBC Smart Invest” APP with current Personal Internet Banking or Mobile Banking login ID and password. To save time in entering the login ID and password, biometric authentication^ is an alternative way to enjoy convenient securities trading service. Please download and experience “ICBC Smart Invest” APP.

Descriptive Information

“ICBC Smart Invest” APP Main Features

Mobile Token Services

Login and trade verified by mobile token service makes trading easier and securer.

Instant US Stock Transaction

US stock can be traded instantly after successful registration of US settlement account and signing the W-8BEN Form in the APP which is simple and convenient.

Open integrated investment account in one click

Apply integrated investment account by “New Customer Account Opening” services via the mobile banking app, simple and saving time.

Import Watch List by One Click

In addition to manually customizing your stock watch list, you can also import your portfolio list with one click by photos to monitor the quotes, changes and trading volume of your favorite stocks. It is time saving, convenient and flexible.

IPO Subscription

Providing cash and financing IPO subscription (if applicable services to help you invest easily.

One Stop Trading Platform

You can trade Hong Kong stocks, eligible stocks under Shanghai or Shenzhen-Hong Kong Stock Connect Northbound Trading or US stocks to let you easily invest in global market.

Free Stock Quote and News

Providing real time quotes of Hong Kong stocks and US stocks (without log-in) and Shanghai or Shenzhen Stock Connect Northbound stocks (after log-in) to help you grasp comprehensive market information. News will be pushed according to your preference. Self-selected stock watch list can be saved at the same time to help you easily grasp stock market information.

Structured Deposit is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

How to Apply a Securities Account

- New Customers

- Existing Personal Internet Banking or Mobile Banking Customers apply for Securities Account by Internet banking or Mobile Banking.

Download ICBC (Asia) “ICBC Smart Invest” APP and “Mobile Banking” APP

“ICBC Smart Invest”

Search “ICBC Smart Invest” through App Store, Google Play, Huawei AppGallery, or scan the following QR Codes to download the “ICBC Smart Invest” APP.

“Mobile Banking”

Search “ICBC (Asia)” through App Store, Google Play, or scan the following QR Codes to download the ICBC (Asia) Mobile Banking App.

Recommended Operation System and Browsers

Below specification are for reference only.

- Apple iOS 10.0 or more updated versions (Default Browser)

- Android 5.0 or more updated versions (Default Browser)

^For compatible phone only.

Note: As there are some differences in browser specifications, some models may not be compatible with the service even they run on the above-mentioned operation systems, and the webpage display of some handset models may result in different layout. ICBC (Asia) will update the system regularly in order to support more models.

If you have any question for above services, please refer to FAQ.

If you have any enquiry for above services, please call 24-hour customer service hotline (852)218 95588.

Terms and Conditions apply.

The above images are for reference only.

Keep your password secure and secret at all times, and change your password periodically.

Please safeguard your password, or you may suffer loss of personal information or assets.

To Borrow or not to borrow? Borrow only if you can repay!

Risk Disclosure:

Risk of Securities Trading:

Investment involves risk and the prices of securities products fluctuate. The prices of securities may move up or down, sometimes dramatically, and may become valueless. It is as likely that loss will be incurred rather than profit made as result of buying and selling investment.

Risk of Margin Trading:

The risk of loss in financing a transaction by deposit of collateral is significant. You may sustain losses in excess of your cash and any other assets deposited as collateral with the licensed or registered person. Market conditions may make it impossible to execute orders, such as “stop-loss” or “stop-limit” orders cannot be executed. You may be called upon at short notice to make additional margin or interest payments. If the required margin or interest payments are not made within the prescribed time, your collateral may be liquidated without your consent. Moreover, you will remain liable for any resulting deficit in your account and interest charged on your account. You should therefore carefully consider whether such a financing arrangement is suitable in light of your own financial position and investment objectives.

The price of the warrants and Callable Bull/Bear Contracts (“CBBC”) may move up or down rapidly and investors may sustain a total loss of their investment. Past performance of the underlying asset is not an indicator of future performance. You should ensure that you understand the nature of the warrants and CBBC and carefully study the risk factors set out in the relevant listing documents of the warrants and CBBC and where necessary, seek independent professional advice. Warrants that are not exercised will have no value upon expiry. CBBC has a mandatory call feature and may be terminated early, in such case, (i) in the case of Category N CBBCs, an investor will not receive any residual value and (ii) in the case of Category R CBBCs, the residual value may be zero.

Investor should bear in mind the key risks of ETFs which include but not limited to political, economic, currency, and other risks of a specific sector or market related to the underlying index; liquid secondary market may not exist for ETFs; changes in the net asset value of the ETFs may deviate from the performance of the tracking index, ETFs may invest in single country and sector; ETFs with tracking index relating to emerging markets may be subject to a greater risk of loss than investments in developed markets; and like all investments, and ETF is subject to the risk of change in policy of the reference market.

Leveraged and inverse products (L&I Products) are derivative products structured as funds. L&I Products are different from conventional ETFs. They do not share the same characteristics and risks. L&I Products are not designed for holding longer than one day; it is for short-term trading or hedging purposes. When L&I Products are held after a period of time, their return may deviate from and may be uncorrelated to the multiple (in the case of leveraged products) or the opposite (in the case of inverse products) of the return of the underlying index. Investors may suffer significant or even total losses. Trading L&I Products involves investment risk and are not intended for all investors. There is no guarantee of repaying the principal amount. Investors should read the relevant offering documents of leveraged and inverse products and ensure they understand the key product features and related risks before making an investment.

RMB Risk Disclosure:

The Chinese Renminbi is currently a restricted currency. Due to the exchange controls and/or restrictions which may be imposed by the PRC government on the convertibility or utilization of RMB from time to time, there is no guarantee that disruption in the transferability, convertibility or liquidity of RMB will not occur. There is thus a likelihood that you may not be able to convert the Chinese Renminbi received into other freely convertible currencies.

Major risks of China Connect Securities (SZSE/SSE Securities):

Investor Compensation Fund:

Trading in China Connect Securities (SZSE/SSE Securities) does not enjoy the protections afforded by the Investor Compensation Fund established under the SFO. Accordingly, unlike the trading of SEHK-listed securities, you will not be covered by the Investor Compensation Fund in respect of any loss you may sustain by reason of a default by any SFC licensed or registered person.

Quota on Northbound Trading:

Relevant governmental or regulatory bodies may impose quotas on the trading of China Connect Securities (SZSE/SSE Securities) from time to time depending on market conditions and readiness, the level of cross-boundary fund flows, stability of the market and other factors and considerations. You should read the relevant details on such quota restrictions, including the quota limit, level of quota utilization, balance of available quota and the applicable restrictions and arrangements published on SEHK website from time to time to ensure you have the most updated information.

Difference in Trading Day:

Stock Connect (Shanghai-Hong Kong / Shengzhen-Hong Kong Stock Connect) is open for trading only when (a) each of the HKEx and SZSE/SSE is open for trading; and (b) banking services are available in both Hong Kong and Shenzhen/Shanghai on the corresponding money settlement days. If any of the relevant exchange is not open or if the banks in either Hong Kong or Shenzhen/Shanghai are not open for money settlement business, you will not be able to conduct any Northbound Trading. You should take note of the days on which the Stock Connect (Shanghai-Hong Kong/Shenzhen-Hong Kong Stock Connect) operates and decide according to your own risk tolerance capability whether or not to take on the risk of price fluctuations in China Connect Securities (SZSE/SSE Securities) during the time when the Stock Connect (Shanghai-Hong Kong / Shenzhen-Hong Kong Stock Connect) is not available for Northbound Trading.

China Connect Securities Eligible for Northbound Trading:

SEHK will include and exclude securities as China Connect Securities based on the prescribed criteria under the Stock Connect Rules. You will only be allowed to sell a China Connect Security and be restricted from further buying, if (i) the China Connect Security subsequently ceases to be a constituent stock of the relevant indices, (ii) the China Connect Security subsequently moves to the risk alert board, and/or (iii) the corresponding H share of the China connect Security subsequently ceases to be traded on SEHK.

Important Notice:

The above risk disclosure statements cannot disclose all the risks involved. If you would like to get a full risk disclosure statements, please visit any branch of the Bank for enquiries. Before making investment decision, you should thoroughly study the offering documents; the financial reports and relevant risk disclosure statements issued by the issuer of the investment product(s). Further you should consider your own circumstances and financial position to ensure the investment are suitable for your particular investment needs. You should seek independent financial and professional advice before trading or investment. This promotional material does not constitute an offer for the purchase or sales of any investment products. This promotional material is issued by Industrial and Commercial Bank of China (Asia) Limited (“ICBC (Asia)” or “the Bank”) and the contents have not been reviewed by the Securities and Futures Commission of Hong Kong.

You are leaving our website

This link will take you to a third-party website that is not owned or controlled by ICBC (Asia).