Cross-boundary Wealth Management Connect Scheme | Greater Bay Area Wealth Management - ICBC (Asia)

ICBC (Asia) and Industrial and Commercial Bank of China Limited (“ICBC”) Guangdong branch and Shenzhen branch have collaborated to provide the “Cross-boundary Wealth Management Connect” services, featuring a cross-border investment mechanism to offer Greater Bay Area residents a wider range of asset management options and a seamless investment experience.

Solid Foundation, Superior Professionalism

As the flagship offshore business of ICBC supported by the solid foundation laid by ICBC Group, ICBC (Asia) leverages our expertise in wealth management and offers customers in Hong Kong and the Chinese mainland convenient investment platforms to seize investment opportunities in the Greater Bay Area and around the world for wealth creation.

Extensive Network and Dedicated Experts

ICBC offers a wide range sophisticated financial services to individual customers in the Greater Bay Area, with over 1,200 services points and a team of over 30,000 dedicated specialists. At every service point, Cross-border ambassadors are stationed to provide professional financial services . To ensure convenient access, we have established core branches in areas frequently visited by cross-border customers, such as Queen's Road Central and the China Hong Kong City.

Northbound Scheme (For eligible Hong Kong residents)

“Cross-boundary Wealth Management Connect” breaks through geographical restrictions, allowing eligible Hong Kong residents to purchase designated domestic wealth management products through ICBC, and benefit from ICBC's expertise and competitive advantages in the global asset management market.

“Cross-boundary Wealth Management Connect” under the Northbound Scheme provides Hong Kong residents a full-process service – from account opening, cross-border fund remittance, investment and wealth management to fund repatriation at maturity/redemption.

Advantages

- Diversify investment: diversify your portfolio with investment and wealth management products in the GBA market.

- Avail of the opportunities in the GBA: seize the growth opportunities presented by the rapid development of the GBA.

- Broaden your investment potential: expand your investment options in RMB products.

- Steady growth of wealth: ICBC’s Northbound Scheme provides you with more than 130 choices of designated wealth management products and public offering fund products with medium - high to low risk, covering fixed income (mainly invested in bonds and deposits), equity (mainly invested in stocks) and all kinds of RMB time deposit products to help you grow your wealth steadily.

Am I eligible?

If you are aged 18 or above Hong Kong resident holding a Hong Kong identity card who is not assessed as a “vulnerable customer” by ICBC (Asia)

How to apply for and enjoy the Northbound Scheme?

Open and pair dedicated accounts

Step 1: Visit ICBC (Asia) branch to handle:

Qualification review

Open a dedicated Northbound remittance account

Documents required for opening a dedicated Northbound remittance account:

- Hong Kong permanent/non-permanent resident identity card

- Valid Hong Kong address proof (only applicable to new customers who do not hold any ICBC (Asia) account)

- Mainland Travel Permits for Hong Kong and Macao Residents

Step 2:

![]()

Customers who hold an ICBC type I account in the GBA2 and have ICBC Internet Banking:

You can apply for opening a dedicated ICBC “Northbound investment account” online through the “Wealth Management Link Zone” on ICBC Mobile Banking3

![]()

Customers who do not hold a Type I account with ICBC in the GBA2 or have ICBC Internet Banking:

You can open a dedicated ICBC investment account under the Northbound Scheme at designated ICBC branches in the GBA

Documents required for opening a dedicated Northbound investment account:

- Hong Kong permanent/non-permanent resident identity card

- Mainland Travel Permits for Hong Kong and Macao Residents

- Photocopy of an account-opening certificate of the dedicated Northbound remittance account

Step 3: Dedicated ICBC (Asia) Northbound remittance account and dedicated ICBC Northbound investment account are “one-to-one” paired and bound

Benefits of the Northbound Scheme

Step 4: By using ICBC (Asia) Mobile Banking, can remit RMB funds to dedicated ICBC Northbound investment account through dedicated ICBC (Asia) Northbound remittance account

Step 5: Purchase qualified ICBC wealth management/ investement products in the GBA through ICBC Mobile Banking

Step 6: Remit the investment funds back to dedicated ICBC (Asia) Northbound remittance account through ICBC Mobile Banking via the same route upon exiting investment

Customers must hold an ICBC (Asia) Integrated Account including RMB Savings Account.

Suitable for ICBC branches in the 9 major GBA cities: Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing.

After successful account opening, ICBC will send a notification to the customer via SMS and mobile banking within 1-3 working days. Customers can also check the progress in account opening by accessing the “Greater Bay Area Wealth Management Zone” in Mobile Banking.

Note: Investment products provided by ICBC have not been approved by the Securities and Futures Commission (SFC) of Hong Kong, and the relevant offering documents have not been reviewed by the SFC. Investors should exercise caution when considering such offers.

Southbound Scheme (For eligible Chinese mainland residents in the GBA)

Southbound Scheme under the Cross-boundary Wealth Management Connect allows eligible Chinese mainland residents in the GBA (Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing) to invest in designated wealth management products in Hong Kong using onshore RMB funds.

The Southbound Scheme provides a full-process service for the Chinese mainland residents in the GBA, including account opening, cross-border fund transfers, RMB conversion for investment and wealth management, and repatriation of matured funds. In accordance with individual investment goals and financial needs, customers can now use the Southbound Scheme to subscribe to nearly 210 qualified wealth management products provided by ICBC (Asia), including funds, bonds, and deposits in different currencies, to enjoy diversified global investment opportunities.

Funds

Each fund is managed by a professional fund company, covering different asset classes, regions, and industries, helping you diversify your investments and take advantage of global investment opportunities.

- Professional management: collaboration with more than 15 experienced international fund companies to professionally manage the high-quality fund products offered.

- Diversified choices: The wide array of asset classes covered by the funds includes money market, securities, bonds, and balanced funds. Investments also cover various regions and countries, such as the United States, Europe, Asia and Greater China area, helping to diversify risks and establish a diversified investment portfolio. You can choose suitable products according to investment objectives, type and risks of different funds. Funds also offer diversified currency options. In addition to HKD, USD or RMB, some funds provide options for EUR, AUD, JPY or CAD in total of 10 currencies for selection.

- Regular dividend: Some fund products offer monthly income schemes, distributing cash or share units to the relevant account every month to establish a stable income.

- Low threshold: The investment amount can be as low as HKD 100 (or its equivalent foreign currency), offering you more financial flexibility.

You can select qualified fund products in ICBC (Asia) “Funds Navigator” to learn more. Please click here for details.

Bonds

Several eligible bond products are available to help you diversify your investments, build a diversified global asset portfolio, and take advantage of every investment opportunity available in other parts of the world.

- Global Asset Allocation: Hong Kong, as a major international financial center in Asia, provides a strategic advantage for investing in global financial markets. ICBC (Asia) offers a wider range of wealth management products, enabling a more diversified asset portfolio and helping you allocate your assets globally.

- Diversified Selection: ICBC (Asia) provides eligible bond products issued by governments, government agencies, financial institutions, and corporate entities, allowing you to steadily grow your wealth.

- Flexible Tenures: You can choose bonds with different tenures according to your financial needs. The shortest tenure is one to three years, while the longest can extend up to 30 years.

- Comprehensive Trading Services: We offer comprehensive bond trading services, including collecting bond interest, exercising rights, and redeeming matured bonds. Additionally, you can leverage our secondary-market trading services to sell your bonds based on market conditions.

Deposit

Our saving accounts support 11 currencies: RMB, HKD, USD, EUR, GBP, AUD, NZD, CAD, CHF, JPY, and SGD and our time deposit supports 3 currencies: RMB, HKD and USD.

Who is eligible?

GBA residents or anybody who has contributed at least 2 consecutive years of social insurance/individual income tax in the 9 GBA Chinese mainland cities

Have full civil capacity

Have two years or more of investment experience

Not assessed as “vulnerable customer” by ICBC (Asia)

The month-end balances of family financial net assets in the past 3 months are not less than RMB 1 million, or

The month-end balances of family financial assets in the past 3 months are not less than RMB 2 million, or

The average annual income of an individual in the past 3 months is not less than RMB 400,000

How to apply for and enjoy the Southbound Scheme?

Account opening and pairing

Step 1: Apply first through ICBC mobile banking for pre-examination of the Southbound Scheme application qualification

Documents required for application:

- PRC Identity Card

- GBA residents or anybody who has contributed at least 2 consecutive years of social insurance individual income tax in the 9 GBA Chinese mainland cities qualify

- Document proof of two years or more of investment experience and required balances of financial assets or annual income

Step 2: Select one of the two ways below to apply for opening a Southbound dedicated investment account upon the approval of pre-examination by ICBC

![]()

By applying through a designated branch of ICBC in the GBA:

- Fill in Southbound online application form on ICBC (Asia) mobile banking

- Visit the selected ICBC branch in the GBA within fourteen days to complete examination and account attestation, including open or appoint a “Southbound” remittance account1

![]()

By applying through ICBC (Asia) Branch:

- Set up an online account opening appointment on ICBC (Asia) mobile banking

- Visit the selected ICBC branch in the GBA to complete examination, including open or appoint a “Southbound” remittance account

- Visit the selected ICBC (Asia) branch to open account during the appointment time

Documents required for opening account:

- PRC Identity Card

- A remittance account2 under the same name opened by ICBC in the GBA

- Residential address proof in the Chinese mainland

- The Chinese mainland Residents Travel Permit to Hong Kong and Macao (applicable to account opening application through ICBC (Asia) branch)

- A business assess qualification certificate of the “Cross-boundary Wealth Management Connect” under the Southbound Scheme signed by ICBC (applicable to account opening application through ICBC (Asia) branch)

Step 3: One-to-one pairing between the remittance and dedicated investment accounts

Benefits of the Southbound Scheme

Step 4: By using ICBC Mobile Banking, remit RMB funds to dedicated ICBC Southbound investment account through the ICBC Southbound remittance account

Step 5: Purchase eligible Southbound wealth management products through ICBC (Asia) mobile banking3/branches

Step 6: Remit investment funds back to ICBC Southbound remittance account through ICBC (Asia) Mobile Banking via the same route upon exiting investment

The customer must hold an ICBC Type I account in the GBA that is connected with the dedicated Southbound investment account.

The customer's Type I settlement account must be opened with ICBC in one of the nine major cities in the GBA (Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing). If the customer holds a domestic ICBC Type I settlement account and the account is not located in any of the 9 major cities in the GBA, it cannot be used for connecting with a dedicated Southbound account. An account must then be re-opened at the domestic ICBC in the GBA.

Customers must open an ICBC (Asia) Integrated Account and register for online banking to use mobile banking services. But bond products cannot be purchased through mobile banking.

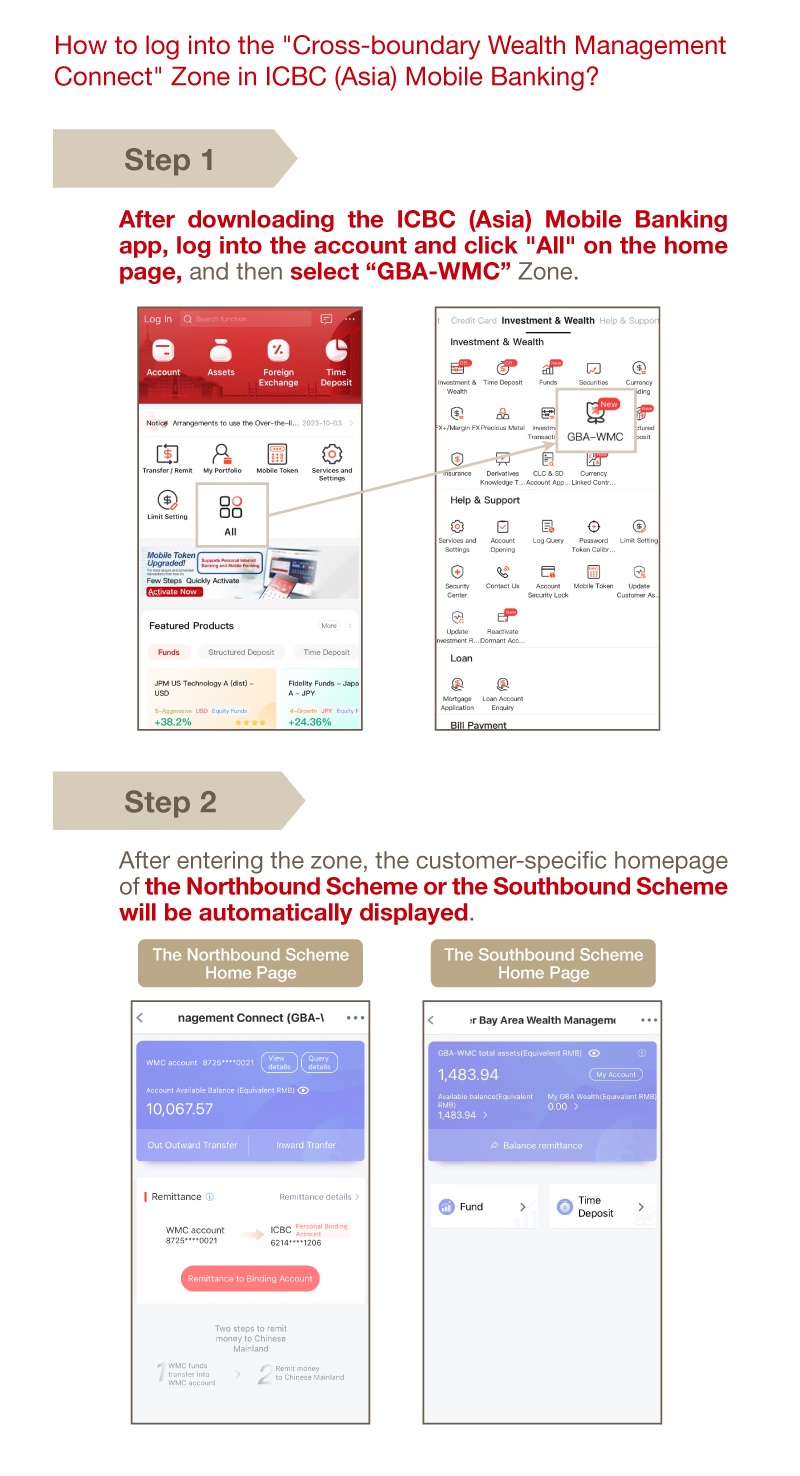

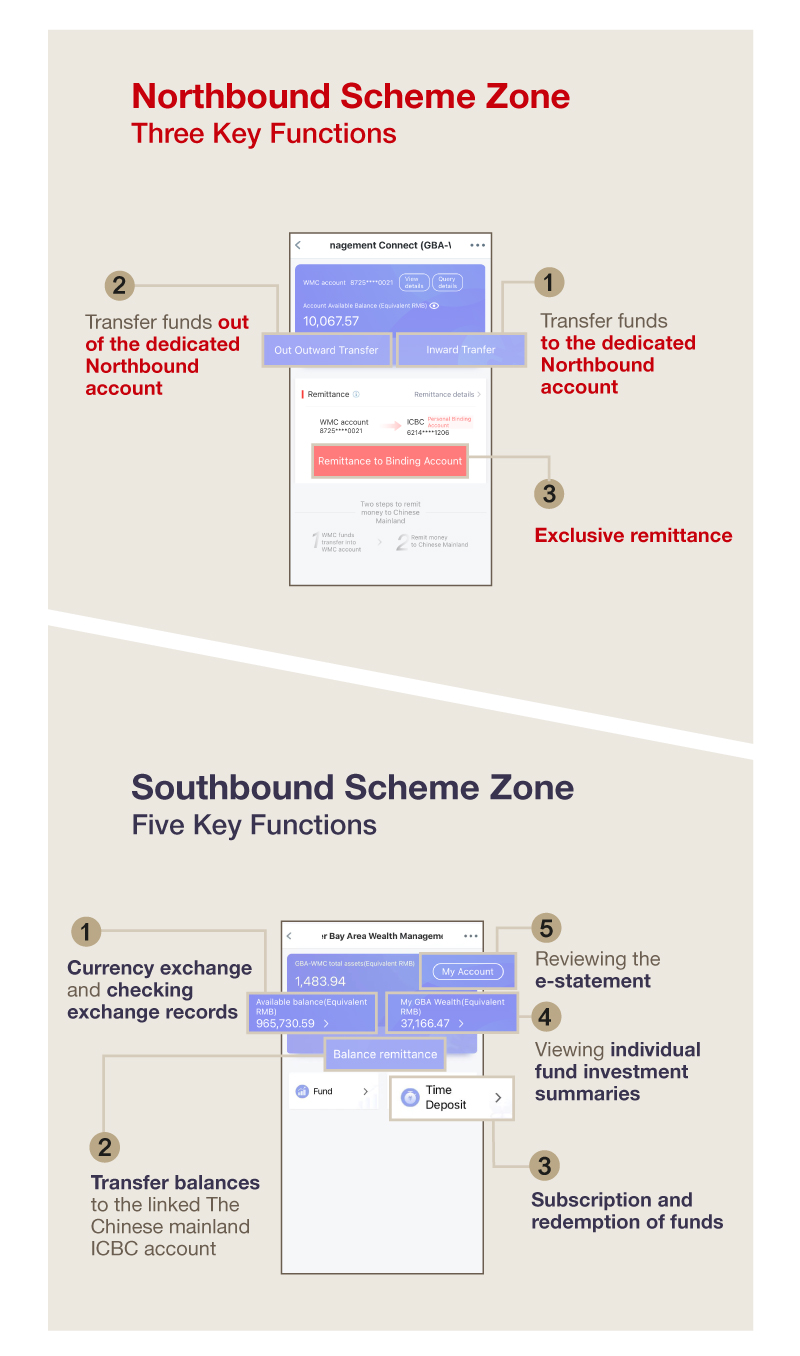

Cross-boundary Wealth Management Connect Mobile Banking Service – Quick Start

Download ICBC (Asia) “Mobile Banking” APP

Search “ICBC (Asia)” through App Store, Google Play or scan the following QR Codes to download the ICBC (Asia) Personal Mobile Banking App.

FAQs on the Cross-boundary Wealth Management Connect

- What is “Cross-boundary Wealth Management Connect”?

A: It refers to investments by the Chinese mainland, Hong Kong and Macao residents in the GBA in eligible wealth management products distributed by banks in each other’s market through a closed-loop funds flow channel established between their respective banking systems (“Investment Products”). A major advantage of the Cross-boundary WMC is the considerable degree of flexibility given to individual retail investors to open and operate cross-border investment accounts directly through a formal and convenient channel, and to choose their preferred investment products.

According to the purchaser’s identity, the money can go into the Southbound Scheme or the Northbound Scheme. Southbound Scheme refers to investments by eligible Chinese mainland residents in wealth management products offered by banks in Hong Kong via designated channels. Northbound Scheme refers to eligible Hong Kong residents investing in wealth management products offered by banks on the Chinese mainland via designated channels. - What is closed-loop funds flow management?

A: Both Northbound Scheme and Southbound Scheme adopt RMB in cross-border transactions. This ensures that funds remitted to the Chinese mainland and Hong Kong under “Cross-boundary Wealth Management Connect” will only be used for the designated purpose, and that proceeds from redemption of wealth management products will be remitted back via the same route in RMB and managed in a closed-loop management of funds.

The Chinese mainland bank account should be bound to the dedicated ICBC (Asia) account, forming a “one-to-one” pairing and bounding. Cross-border remittances must be conducted in RMB to ensure the closed-loop management of funds flows. Therefore, all related investment funds can only be remitted to the dedicated remittance account via the same route at all times. - Can Southbound Scheme or Northbound Scheme customers open dedicated investment accounts with multiple Hong Kong banks at the same time?

A: No. Each investor under the Southbound Scheme or the Northbound Scheme should, at all times, have only one dedicated investment account and one remittance account in a Hong Kong bank. - What is the individual investment quota? Can the funds be used for other purposes (such as pledge financing, purchase of insurance, etc)?

A: The individual investment quota of each Northbound or Southbound investor shall not exceed RMB 3 million at any time. Investors can concurrently invest via a bank and a licensed institution. The individual investment quota of each intermediate shall not exceed RMB 1.5 million. The funds under dedicated Northbound or Southbound investment accounts and the designated investment products purchased cannot be used for other purposes (such as pledge financing, insurance purchase, etc). Funds in the dedicated investment account also cannot be transferred to other accounts, and withdrawal of cash from the dedicated investment account is not permitted. - How is the usage of individual investor quota calculated?

A: Usage of individual investor quota under the Northbound Scheme = Cumulative remittances to the Chinese mainland under the Northbound Scheme – Cumulative remittances from the Chinese mainland under the Northbound Scheme.

For example, a Northbound Scheme investor remits RMB 0.8 million to the Chinese mainland to purchase investment products. Then the usage of his/her individual investor quota will be RMB 0.8 million. If the investor subsequently sells part of the investment and remits some of the gains and principal, say RMB 0.2 million, back to Hong Kong, his/her individual investor quota usage will be RMB 0.6 million (i.e. RMB 0.8 million - RMB 0.2 million).

Usage of the individual investor quota under the Southbound Scheme = Cumulative remittances from the Chinese mainland under the Southbound Scheme - Cumulative remittances to the Chinese mainland under the Southbound Scheme

For example, a Southbound Scheme investor remits RMB 0.8 million to Hong Kong to purchase wealth management products. Then the usage of his/her individual investor quota will be RMB 0.8 million. If the investor subsequently sells part of the investment and remits some of the gains and principal, say RMB 0.2 million, back to the Chinese mainland, his or her individual investor quota usage will be RMB 0.6 million (i.e. RMB 0.8 million - RMB 0.2 million).

- What is the aggregate quota for the pilot scheme of the Cross-boundary Wealth Management Connect in the GBA?

A: The Northbound and Southbound Schemes are each subject to a quota of RMB 150 billion, shared by Hong Kong and Macao. Instructions for fund remittances from Hong Kong to the Chinese mainland under the Northbound Scheme may be put on hold if the aggregate quota is used up, but remittances from the Chinese mainland to Hong Kong and investment instructions for funds already remitted to the dedicated investment accounts will not be affected. Similarly, instructions for remittances from the Chinese mainland to Hong Kong under the Southbound Scheme may be put on hold if the aggregate quota is used up, but remittances from Hong Kong back to the Chinese mainland and investment instructions for funds already remitted to the dedicated investment accounts will not be affected. - What is the basic eligibility for the Northbound Scheme?

- Aged 18 and above

- Hold a Hong Kong Identity Card (permanent or non-permanent residence)

- Hold a valid Mainland Travel Permit for Hong Kong and Macao Residents

- Invest in personal capacity (not as joint-holders or corporate customers)

- Be assessed by Hong Kong banks as not being a “vulnerable customer”

- What is the basic eligibility for the Southbound Scheme?

- Aged 18 and above, and hold a valid PRC Identity Card

- Have full civil capacity

- GBA resident, or anybody who has contributed at least 2 consecutive years of social insurance / individual income tax in the 9 GBA Chinese mainland cities

- Hold a Type I account debit card with the Chinese mainland bank in the GBA (if the customer has not opened a Type I bank account, he can apply for one while submitting the application for Wealth Connect service)

- Have 2 years or more of investment experience and meet one of the following conditions: the month-end balances of family financial net assets in the past 3 months are not less than RMB 1 million; or the month-end balances of family financial assets in the past 3 months are not less than RMB 2 million; or the average annual income of an individual in the past 3 years is not less than RMB 400,000

- Valid domestic address proof

- Invest in their personal capacity (but not as joint-holder or corporate customers)

- Be assessed by Hong Kong banks as not being a “vulnerable customer”

Civil legal capacity must meet the following two conditions: 1) The individual is at least aged 18 (for individuals aged 16 or older but under 18, if they rely on their own income as their primary source of livelihood, the law will consider them to have full civil legal capacity). 2) Mentally sound.

The 9 Chinese mainland cities in the GBA are Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing.

For more information about “Cross-boundary Wealth Management Connect”, please visit the website of the Hong Kong Monetary Authority.

Please note: The information regarding “Cross-boundary Wealth Management Connect” provided here is based on the “Implementation Rules for the Pilot Scheme of “Cross-boundary Wealth Management Connect” in the Guangdong-Hong Kong-Macao Greater Bay Area” issued on January 24, 2024, and the latest information from the website of the Hong Kong Monetary Authority. It is for reference purposes only and should not be considered as investment advice or solicitation for investment in any products mentioned in this text. It does not constitute or should not be regarded as ICBC (Asia) actively promoting its “Cross-boundary Wealth Management Connect” services to the public outside Hong Kong.

Customer Service Hotline: (852) 2189 5588 (press 2 after selecting language)

Enquiry or Feedback: wmc.enquiry@icbcasia.com

Reminder: Don’t lend or sell your account. Don’t risk your future for quick money. Investment involves risks. Terms and Conditions apply. Please click here for details.

Note:

- RMB is used for both Northbound Scheme and Southbound Scheme transactions. The funds remitted by customers are for “Cross-boundary Wealth Management Connect”. Funds obtained from the redemption of wealth management products are repatriated cross-border in RMB, and managed in a “closed-loop” funds flow.

- Each customer under the Northbound or Southbound schemes can only open one dedicated investment account and one dedicated remittance account in one bank. Each client’s investment quota is limit up to RMB 3 million, which is not to be exceeded at any time. Investors can concurrently invest via a bank and a licensed institution. The individual investment quota of each intermediate shall not exceed RMB 1.5 million. The funds in the Northbound or Southbound dedicated investment accounts and the designated investment products purchased cannot be used for other purposes (such as pledge financing, insurance purchase, etc).

- The aggregate quota of the Northbound and Southbound schemes is each subject to a limit of RMB 150 billion, shared by Hong Kong and Macao. Instructions for fund remittances from Hong Kong to the Chinese mainland under the “Northbound Scheme” may be put on hold if the aggregate quota is used up in remittances from the Chinese mainland to Hong Kong, but investment instructions for funds already remitted to the dedicated investment accounts will not be affected. Similarly, instructions for remittances from the Chinese mainland to Hong Kong under the Southbound Scheme may be put on hold if the aggregate quota is used up in remittances from Hong Kong to the Chinese mainland, but investment instructions for funds already remitted to the dedicated investment accounts will not be affected.

- Deposits in Savings Account of ICBC (Asia) Northbound remittance account / Deposits in Savings Account and Time Deposits NOT exceeding a term of five years of ICBC (Asia) Sounthbound investment account are deposits qualified for protection by the Deposit Protection Scheme in Hong Kong.

- Industrial and Commercial Bank of China (“ICBC”) is ICBC (Asia)’s cooperating bank in the Chinese mainland for Cross-boundary Wealth Management Connect services. ICBC is not authorised institutions as defined in the Hong Kong Banking Ordinance and is not subject to the supervision of the Hong Kong Monetary Authority. ICBC cannot carry on any banking business or business of taking deposits in Hong Kong. Any deposits maintained with ICBC is not protected under the Deposit protection Scheme in Hong Kong.

Risk Disclosures:

Investment Funds: Investment in investment funds involves risks. The prices of an investment fund may move up or down and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling investment funds. When investment denominated in non-local currencies, please be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance of any investment is no guide to its future performance.

Bonds: Bonds are mainly for medium to long term investment, you should be prepared to invest your funds in bonds for the full investment tenor; you could lose part or all of your investment if you choose to sell bonds prior to maturity. You should bear the credit risk of the issuer. The price of bonds may fluctuate and the factors affecting market price of bonds include, but not limited to, fluctuations in interest rates, credit spreads, and liquidity premiums. There is an inherent risk that losses may be incurred rather than profit made as a result of buying and selling bonds. Industrial and Commercial Bank of China (Asia) Limited does not guarantee the existence of secondary market.

Currency conversion: The value of your foreign currency will be subject to the risk of exchange rate fluctuation. If you choose to convert your foreign currency to other currencies at an exchange rate that is less favourable than the exchange rate in which you made your original conversion to foreign currency, you may suffer loss in principal.

Risks relating to RMB: The Chinese Renminbi is currently a restricted currency. Due to the exchange controls and/or restrictions which may be imposed by the PRC government on the convertibility or utilization of RMB from time to time, there is no guarantee that disruption in the transferability, convertibility or liquidity of RMB will not occur. There is thus a likelihood that you may not be able to convert the Chinese Renminbi received into other freely convertible currencies.

Important Notice: The above risk disclosure statements cannot disclose all the risks involved. If you wish to obtain the comprehensive risk disclosure, please approach our branch staff for enquiries. Before making investment decision, you should thoroughly study the offering documents, financial reports and relevant risk disclosure statements issued by the issuer of the investment product(s). Further you should consider your own circumstances including financial position, investment experience and objective to ensure the investment is suitable for your particular investment needs and risk tolerance capacity. You should seek independent financial and professional advice before any trading or investment. This promotional material does not constitute an offer or solicitation for the purchase or sales of any investment products. This promotional material is issued by Industrial and Commercial Bank of China (Asia) Limited (the “Bank”) and the contents have not been reviewed by Securities and Futures Commission.

The Bank distributes the fund product for the fund houses and the fund product is a product of fund houses but not that of the Bank. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Bank and the customer out of the selling process or processing of the related transaction, the Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the fund product should be resolved directly between the fund houses and the customer.

“ICBC (Asia)” or “The Bank” is the abbreviation of Industrial and Commercial Bank of China (Asia) Limited.

You are leaving our website

This link will take you to a third-party website that is not owned or controlled by ICBC (Asia).