|

I. Definition

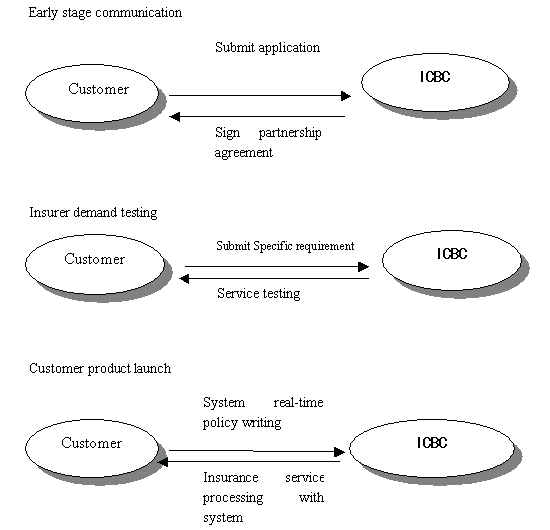

Bank-Insurance Link System refers to banking service system where the insurers connect the computer systems of the insurer and the bank through designated line and then update the data between the systems according to the standard program interface provided by ICBC. It is the banking service system that enables insurance policy writing and other transaction processing for individual customers ("Customers" hereinafter).

II. Product Introduction

Supported by the Bank-Insurance Link System, ICBC can provide multiple services for insurers and individual Customers:

1. Policy purchase: realize the real-time passing of insurance applicant information through system connection and print the insurance plan at ICBC counter after it receives the insurer approval information.

2. Insurance withdrawal: The insurer entrusts ICBC for insurance policy sales. But during the cooling-off period, the bank withdraws from the policy on behalf of the applicant.

3. Enquiry: As per applicant's entrustment, ICBC enquires information relating to the insurance products, such as policy number, type of insurance, number of policies purchased, renewal time, etc. The applicants who want to entrust the Business Offices for policy enquiry shall bring with them the personal ID.

4. Partial policy preservation: Under the entrustment and authorization by the insurer, revise the key insurance terms and conditions for applicants who purchased policies through ICBC branches and sub-branches. It mainly includes change address, postal code, and telephone, etc. of the applicant, the beneficiary and the insured.

5. Notified freezing and un-freezing: The applicant pledges its policy holding at ICBC for insurance policy pledged loans. The deal is communicated to the insurance company through real-time link and the party freezes the policies according to the confirmed outcome or vice versa.

6. Agency collection and payment of premium and claim: During the period of due premium payment, ICBC collects as an agency as for insurance premium paid by the Customer.

III. Target Client

It is targeted at the insurance companies that have wide business network coverage, nationally centralized information management, and high requirement for speed of bank agency sales.

IV. Service Procedure

|